- #HOW MUCH DOES QUICKBOOKS DESKTOP PAYROLL COST MANUAL#

- #HOW MUCH DOES QUICKBOOKS DESKTOP PAYROLL COST PRO#

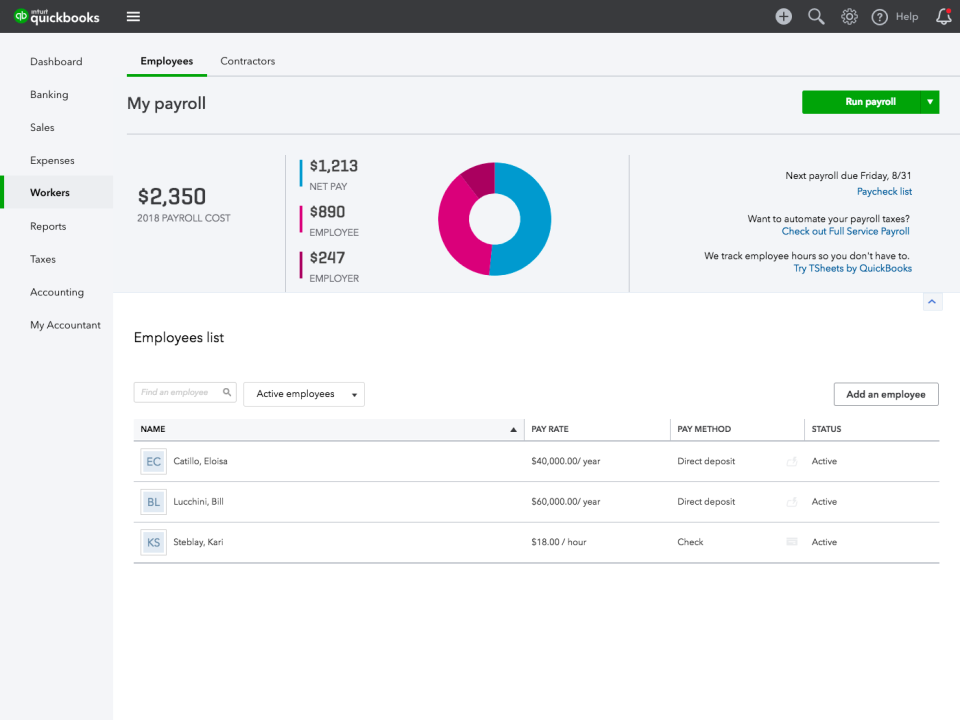

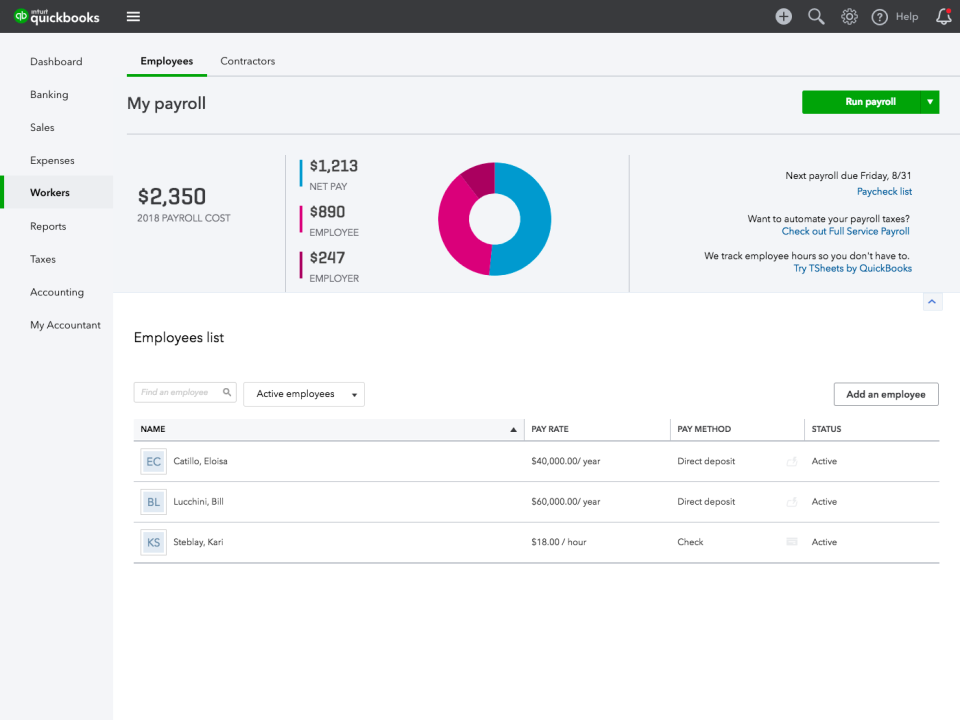

How do I apply a payroll deduction to an invoice in QuickBooks? Easily pay employees, file taxes, and get instant W-2s at year end. Includes 1-year prepaid Payroll Enhanced subscription.

#HOW MUCH DOES QUICKBOOKS DESKTOP PAYROLL COST PRO#

QuickBooks Desktop Pro Plus with Payroll Enhanced 2021 With Pro Plus 2021, you get even more automation tools to save time and boost productivity.

From the Deductions/contributions ▼ dropdown menu, choose New deduction/contribution.ĭoes QuickBooks Desktop Pro 2021 include payroll?. In the deduction section, select + Add a new deduction or + Add deductions. Go to the Payroll menu, then select Employees. How do I enter payroll deductions in QuickBooks? Enter the amount of the purchase and OK once done. Go to the Payroll Info tab, then add the Employee Purchases payroll item in the Additions, Deductions and Company Contributions section. Select the appropriate employee, then click the pencil icon to edit. Go to the Employees menu, then select Employee Center. How do I record payroll deductions in QuickBooks?

Select the topic Calculate payroll manually (without a subscription to QuickBooks Payroll).

#HOW MUCH DOES QUICKBOOKS DESKTOP PAYROLL COST MANUAL#

In the Search field, type manual payroll and press Enter on your keyboard. Click Help at the top, and then select QuickBooks Help (or press F1 on your keyboard). How do I do payroll in QuickBooks without subscription? Head to the Payroll Info tab, then add the 401(K) deduction item in the Additions, Deductions, and Company Contributions section. Choose Employee Center, then open the profile of the appropriate employee. How do I enter payroll deductions in QuickBooks desktop? (If you use the Gold or Platinum version of QuickBooks Enterprise, payroll is already included in your subscription). Can I use payroll with QuickBooks desktop?Įvery QuickBooks Desktop payroll option is compatible with QuickBooks Desktop Pro, QuickBooks Desktop Premier, and QuickBooks Desktop Enterprise. Follow the screens to add your employees, then set up your company payroll items and taxes. Elite: $125 per month plus $10 per employee per month. Premium: $75 per month plus $8 per employee per month. Keeping this in mind, standard pricing for QuickBooks Payroll is as follows: Core: $45 per month plus $4 per employee per month. How much does it cost to add payroll to QuickBooks desktop? 21 Can I still buy QuickBooks desktop 2021?. 19 Will QuickBooks desktop be discontinued?.

18 How do I categorize 401k contributions in QuickBooks online?.17 Which 3 types of deductions contributions can you set up for employees in QuickBooks online?.16 How do you record payroll expenses and liabilities?.15 How do I account for employee payroll deductions?.14 How do I record ADP payroll in QuickBooks desktop?.13 How do I edit a payroll deduction in QuickBooks?.12 What is the journal entry for payroll?.11 How do I add a new payroll in QuickBooks online?.10 Can I do my own payroll in QuickBooks?.9 How do I apply a payroll deduction to an invoice in QuickBooks?.8 Does QuickBooks Desktop Pro 2021 include payroll?.7 How do I enter payroll deductions in QuickBooks?.

6 How do I record payroll deductions in QuickBooks?.5 How do I do payroll in QuickBooks without subscription?.4 How do I enter payroll deductions in QuickBooks desktop?.3 Can I use payroll with QuickBooks desktop?.1 How much does it cost to add payroll to QuickBooks desktop?.

0 kommentar(er)

0 kommentar(er)